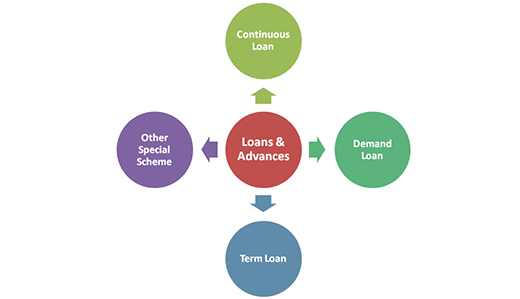

The term loan refers to a type of credit vehicle in which a sum of money is lent to another party in exchange for future repayment of the value or principal amount. In many cases, the lender also adds interest and/or finance charges to the principal value which the borrower must repay in addition to the principal balance. Loans may be for a specific, one-time amount, or they may be available as an open-ended line of credit up to a specified limit. Loans come in many different forms including secured, unsecured, commercial, and personal loans.

An advance rate is the percentage of the value of the collateral that a lender is willing to extend as a loan. The advance rate helps a borrower determine what kind of collateral to bring to the table to secure the desired loan amount and helps minimize a lender's loss exposure when accepting collateral that can fluctuate in value.

SAGAR FINANCIAL SERVICES

Was established in the year 2007 with an aim to provide One Point Solution in Various Segment of Financial Markets.

405 Ashwamegh Avenue,

Near Mithakhali Under Bridge,

Ahmedabad – 380009

+91 9898010298 / +91 7698089808

Copyright © SAGAR FINANCIAL SERVICES 2021. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-50156 | Date of initial registration – 04-Jan-2011 | Current validity of ARN – 20-Aug-2025

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors